Luxury leaders have a conservative outlook for 2024, with only 50 percent expecting higher or significantly higher profits compared to 2023.

The same question 12 months ago yielded 81 percent who expected higher profits versus 2023.

The findings are part of Agility Research & Strategy’s annual Luxury Leaders Pulse Study, interviewing more than 50 senior and C-suite executives across sectors in Asia, Europe and the United States.

The report provides insights on the priorities and challenges that these executives see in the upcoming year and how they expect the luxury sector to evolve.

Bullish on China, U.S.

Despite all the headwinds, expectations about profits from China are in line with the past year, or towards growth, while approximately 20 percent expect businesses outside China to slowdown this year compared to 2023.

Luxury leaders' outlook for 2024 versus 2023. Source: Agility Research & Strategy

Luxury leaders' outlook for 2024 versus 2023. Source: Agility Research & Strategy

China is expected to continue being a key revenue source for luxury in the next five years.

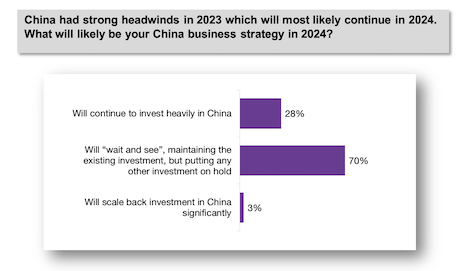

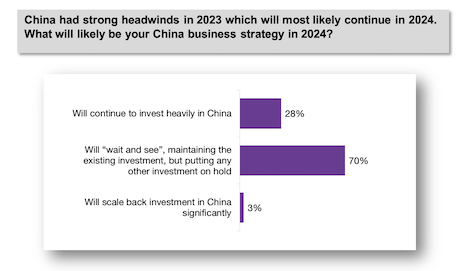

However, companies are adopting a wait-and-see strategy for China in 2024 due to strong headwinds in 2023.

Luxury leaders' China business strategy in 2024. Source: Agility Research & Strategy

Luxury leaders' China business strategy in 2024. Source: Agility Research & Strategy

A larger share of respondents (21 percent) now see the U.S. as providing an increased share of profits versus 2023 (16 percent), indicating that luxury brands are taking into account the wider shifts in global luxury consumption.

As a result, luxury leaders took some decisive actions in 2023.

For example, most leaders reviewed their processes and business models.

Beijing skyline at sunset

Beijing skyline at sunset

In Greater China, cost-cutting measures were also implemented, while other markets increased investments in ecommerce and digital marketing.

Redefined terms

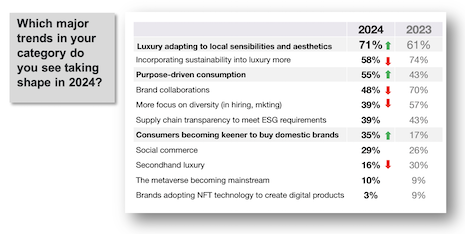

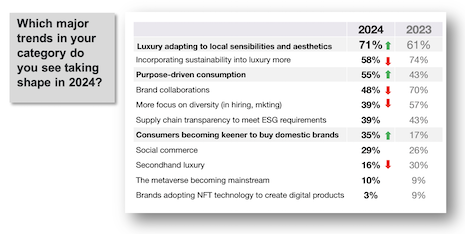

The major trends that luxury leaders see for 2024 are localization and cultural immersion, sustainability being incorporated into luxury and purpose-driven consumption, and brand collaborations gaining importance.

Trends that the responding luxury leaders expect to take shape in 2024. Source: Agility Research & Strategy

Trends that the responding luxury leaders expect to take shape in 2024. Source: Agility Research & Strategy

Luxury leaders have a very clear understanding of how the definition of luxury is evolving in 2024.

Luxury is defined as a broader proposition that encompasses all lifestyle products and incorporates sustainability.

Game-changers for the luxury industry in 2024 will include personalization, service, scarcity and high desirability.

FINALLY, AGILITY asked luxury leaders what keeps them awake at night. Two topics stood out.

First, weak consumer demand is the topmost concern.

Next, geopolitical tensions, especially between the U.S., European Union and China, are also expected to impact business.

{"ct":"9VH\/IdZIg\/yUBALYUs7mgLTwVNY3Z+u9Fr3JjN+nSy50KN6blC6fPqFAw1V3wZ2FZRIq0ZaG3GAvSPw1TVthxtWgGLexN\/4SKmsfNFXkFNUwfgDE\/14AMHS8L9mb2e4\/\/Mw4FoJzrdb6OZ9qp8nguOiCTRArGngLNZAsUczP6YgEw+yZR23SNZM1dSDI8iVdEpQVCvPhM94gmcQO6CVDMxZBl97Re74N7LQAi87T3VJGRwW7oQN8S8ue+C\/BqPHERRpMrYtTQDU3O\/jQoyKKhiKbkx3wjTXNbaVoS\/0nOxbawvhyfDlJPM94FRM0B94lo9SI4eScRxgPbdbZ9eX18K3NoWjwa6mOU1zGASKf+Z6G+8duE7Q+t+lDhDJ1ts2tcsmm37pb9nFUWcWgQrk17EzI8lBz1WVtKIuh0TVozQjCuI\/gs7atIdnTuT6ncd\/FlHYzgPZBR+JQ4JG0PQkdikYYql+UBRMcNdxKcVvLQagxXY6UEs+ChM30zpYq05avbXZUbyFXImxxbHEuSmdjrA6lYxJyZ45Mc6Jgg7CQeKT9DvSqOETWjAlRS5aNTFmMwaZap8B6rRtKszMj+RbaOHGNo1av42WcZ7TVcPqxPFDpbbBH2tdTxQDrjvFaHh2u2SVd8VfYPXUx97KOmHk18TcNApl4A26JbvqIGEqpGerFYDyxKmTDDOtvLaR143WxVxDi31Zd\/Qu+Q2l0XNYA\/BLwaYjStDX82ZHtJTSAojCWtEzrNcB9Yw3Hes0S3CBbuUZDbKsyustq1Cg6MUKJvHbzMOmV+zdMuO+tRkPiUCABlcilDCrVxfGLJ\/5sDA9VCi7lHNe\/7SQwCFPndS0LKtg4cfKQGk7XqWfmIjLkTHJJwPgriJTlBluBrjguFBmtwHUuaoBiYmwAjMf1Dj0+ixmdrBl1mr1kQ7LrYzBljgrJnX3Eg5ybuAY11OLrpQ6LnTq5F6FUfkx11Aq2Lar8i5HJhMCcvZNf4jKCRvyalaO9zOSUcXCMLl6kmVLaCuuViKkTJKyCN3EEutaIKf61pA05keS3sC9+5Na7kMFA1O4tw\/Lx\/8vGFOdUaM8fKSZZjpvlJe9gKLcfM7NXWhlKb3aQ5SIuIfzS1vs\/xmA4PJkVGwn2RKODVvJ\/gV80vxHoKkk70LIo0n\/jyd9uV3JZjH58XY+c7HHZ7TUIAY\/iD4WsLl62mJ7C6e9h7aEUwT3\/pEFaBY6SIJ66Ha\/cmHjQeUIaIJ6BSsRZe5RSS8mglCW4l78s2p9z4ZewDR7CsRrlsdHIhmLI5aXdyqC5wjEvcc4rjj2CSOWKsqhWL\/9fpQODjxHtd11f+EaBKTQlq0maPvzrRNIorAl6UduegbBI+hSmXs7KRrDpK2UruI8sydgcZiOVwV\/362uFrsL3pz9qZkNW4Dst1Vxt1P6MIgK6ahSlx1Sbv56sYqiBs4DSg1Kivb0fKJ5Y9d8tyFRbQzLB2Tl4aiUmiluPWlbFVWRBRTAgiDu4I5EI1j\/oLZIgEpgH8K5Xwhm1leN64gnU\/sRTpO\/SL\/\/FdmER2FuT3UkJDjbU7PQ2GjBpGUYu7T1D3t\/6i1reRaNFhS+njES9GMTeeBaC5Xr1X3HcAMKPB0m1zigxtPlHPgQBryNCluICRZZil8gu2RzXVawA7dcKU0tpUcQVgTu7jMy0DmYtN8te0ByuiJ0hERkCxVy4KU49b5AggKco3htgemqDyFQI5X6mZaOlRilhpkUGmUT\/WSVYE\/jMNdZEmQ3o5f9upVZJqAjJDOZR\/ets9BLlGRYeOlddk4kqFHWLxmzmbVjihabiHjvhiv11e02YENpq4yQdyq6miaxgCeQGLA1coAw295vdxQe8fwqVUhQ7+Dsr0dNOmviqxwBenfPR4RwhAnM4DZvRAwCsgaDQCi3i5+uPP5i7v\/SED\/6vkVoT\/z2OJGtL9jyEBI5Qfxu2ffPocqFtCdaE9zMOskVKtJkGCFwmCx9m99TmE2zdIGVyf6LJVjN27N\/qbMS03ZhnO0+FtWqNzbn1Vjhkd7irvXTJFP5Q1jNfLANg9u5CXT+2wBLrTVi+QvIgPl32g9RNr0+6eThYDbT8OBllBbwE\/qnC3l+yilU2ZfXkLNuPood+H7XxoT453zM8uxrlxBuZdtDPrngU0iayCquqFa55qZhwUVqeXN0IGm3xhpYJGqf6zHr5S6aF7ji6iyZQYFyEotPi55izueOpsUNt04ZkQyOSsbcoRDUolduig9fe8sa+P6OO2VX2UO8QwwzAeQis2EkMWTRSRtMXZuyDrUdd2T7TfrhiBTrrRnFkV4DMfdDKtmn1M\/F9NBP\/bovTn4aHJNI4FARGq4KIBGvvfNV1Jez+P4HGv0ow32G8yT8yMr63vs5t6fEW+0Jo1k6t9PRHOxQwXpgJqHDIO62COrq5uUVUO\/KBvWYotvaeudx0onLZqQ4i26uxZobYr97vEbH+VR\/KB\/KtLMsF+Xp\/ZgnT7Nc6Kdk9OcsA1TzIO9i35hHezB58i0FwDTVAv+01OaSRRpGfbasUa\/RIIO3\/1432K4JCyULS3jkwuQTbnWeZru8ideSCy4Oz7Zw15oFKskMdCh9C7ZxveyU0GyT1gDM1zqvdexjSk9\/OkekCnocMrDtzdiVm0Vlxe3swgwR5Y2oAD6EoYbbAVUUt4sTvrfjTBi7YWgBA8HXkT3ibtK+qmF35SE0h4ApfDl58IB6mt29FM8+3ETxaV4VIaofn4zHFSFVAhxp6Ccv+5CtG5akXBeZVE6FM0v8fg5kb9uw91vLIF5BJpYSk7MS\/ECvirAGicP98y5KrBbtA+gQsk2UXmVGK0HwqRWrhaBak4ozEkmw2pZz09GTAmIiqTjNosxnKzpZyhw2gjn2pOvCZC9J1nfnthP4S3k4+5N1TNDEZG6zMKgcpqiHUqw8sAb1MR3IkL+ZTAJxrG+c8pgfjCY8a4\/A1cDOIcIlLJCuifYJvQYymd+ZbqcTRYcwDE7eckKPdi1ue9N7kMJsUbDKCSHR1NgEwugJivDU3cZLVkX9fmpbX3BikDAOy1H1QfqkToKLmkFj\/byzdy6JFyLTsEM33rftagNI5SXsYsVB8STuGQF9y2ni1nhbA3tqMOS99RvwhJXtziEBN6b4a6MNJyPINj8FlN55ZvWtoe44wNXtNLFbDwanXlXnfj\/Eob3v42ozXrZ7Tc8zh2PiiJuGfAeBRxyheB3kLteBQENNplXp2HyBgGD210+hh1TTht2Wim1IGkHZbbgkCkBELdvMCxQzesfitxOclPAhoS6G7Xc3hjjmjSIXMh7Kqi15FjuC37FrmEqFZQ6U3Zyh+LYzOgnJqKQW5EQvykJO8uQqVfC9hYIbypRPkQU\/WlbZJe7u\/nTnwDfmjJFOqDiq4mSkW8AWo7KhvDuvFiT67e0rQkUXEmVxY8RPnvQwMH9r6NtpK2\/RsezOqegmIOSXV29kJyF9MZmPb04uq7LjwLIf+bEkmiKt1EGjC\/6j8ZO1SksAMBJy4Z7rOdsTbmZf71TeAOmE8Lxpd36NwEGxFpSs3\/0tHLI45gA8iSeEArDaeFPBFv7wAi8i8HRmJ4xqUjYlf7RaSyzT9R\/FMPrS1eRTOQ7zxYZjyjWBcf\/FcbaeN7rtGTCvqd3IXDjds7zTOOs2eIphI1IOI8ykY04FtPLb8I4dIZvJL6\/J\/fF6e8Odg2BC9RWU9m44wsLgAPBDwmks3KXrCzn7jpk2cfe\/tqFKO3oOpf9ctQmOjDDEDLavmrSp2KvrkFZPqLZmQ3G6yLsJ1dCAID2MtsxF9DWRKtiMR\/GotAkiE\/Tv+pjbCPRrCGIq9+q+8tKs\/R\/je8bFr+GBZj\/gm6VtkBijLUKFy9nRAOXgHL55uZLyyvrYC2WTLLPQgdw8mwyxXGA5oAq27zWn4u8hrggnH1EbjVhqHm8V9bevvTxn7H8TxXSZMcCaEjkm92LeoU4\/QR5GP9\/FcmitQ+PjjMMZMdbOFDBTG6TeeJw3bYH72zsFWv28Ifu9Ru2j5ru9ystflsGiicXO4kEKymdT1rV5Hvc2ZO0RuHPVWcq1LPlvszy2Pw9tRxLAC+bK39f8t1VcKACPyxv3rRU3IyGdal2lvkzIJuL7dGCoO05cvu2mGmvYwQe13QVpMf3R3L9Cd5nsdRjdW1x6sDVfnAfL5Ru3BVi\/tRiknr7+JfeF6zgctOzr9KSiTUKYQToQiv7vANdRK0g3FQ2CsndvF\/TiS1RSHdajTIGiKAp3WoCKnNU6+hJwjPk44mk5bJoIURF9sF8PiVo9yT2JiZQbgtXPNvH7VJiRsvpr6AvyJn4HcdPoKvXyjXhHmpkGpr2O4iL4oT8aZc\/woUf6Fxo1FC7DzwWDqM7wu3zn5G4DrcIHhzAWeYqWspliD\/nUS+RZGT3OyRjxfAbl+ae6tku1AGJvPND4ijqiLwwGMZ6Db92KkHSbkgMdV6bzJcQDpshoYWOKSKWgMJpZCZNRfu2ryto4U2muwSB3nF9zIFyn1BH\/Cv97SIA8GpPehRrDKP9tdcX4UFKDbvhCKkdF5BrlUxZrR6EA1pVAT7Tkvxx\/d265PQOSu2Ju\/Mz7hZqXvszwgqpUaHIo7E9ctiFSHD7Vtea2VAkjEfRVS1fUNfebJsCLM0BoBaEOlvyg45nzvVB3Et9E+NdR\/5kQDDHVfyUtQPPUd4RXLRBLnKwvn+3ObDkKXU0oMUppdmoAZ+jeOv\/VAWhYA9xynMO1eE\/ZuAyaZWUm6SJR9pVaRCP1UZ29+ZJUvTLcJQGmKDjzh0QWZKtVzJDB8c\/wXKFdltKHRbyhuofs1ol9gxW71V6C7c7aaM22JTOp65PhgpriAWi0vOStyg8J3Pl71iqhevz6WU16aML3r\/pYf\/sw9efXcubYl1dg1oeevHT2il4HDz+48QcdJbKOfgvn0DCVJDa2kiOP+M9lQ6fZDQrP0rN4K6GHRO6wpeLcwoMTlFhfdVOMtmUk\/Pb\/9hPHiRKICBEdmsNPKikJc83XEQb7tn4Q6hqdkRZbp42NFsZHwiS4mH+shnrHVjPtwvY10qLHxw0Z7qJkHCs3kttLLSTti7yk8RDKkzzVnLIq1wiAfiI01nIeHHNaoXyVSVtCfG7XDWZsgScdCu+qbT4bnS7Zxwi5zpWsz+MjtDZvdiKYuQtTj+jkCKZIR+\/8oS6Chk+hAC0mmwEWWfMtcff5HQi26HgwEHvbXOeG5QmkgRdpPBd5VBIwDH872woHxkf88OcuIlJ++TU874J4UuzRUdIPp+IIT90rd+Yis4hqHZtqT5wM5MN8NN0E95g2a5RoYJTkx8qLBnR2fMR7s6IzmPVUROicSxJhXx6hgMosl5DU6qex\/kMNXvC8YCJFRbJZ8QnFQUgEHUdhGeZLqrKDXozd9OoWldKOpTNtAMzYEkyxQEhIy8xIZS1jHw+nBGLzASXDnYBnxuE8FfNx3QF8dA6L7HxbRFQLl7YpQHiZqlSRxFyZfmORJy0b16w\/bxpyrz5OwNoD7lTsiyKNSQZC8vOV19zgM\/vxuNTGUUw2N6fVG8Pd6IvbgcbQIl3ZaX6fk4gRJZiueoLrrHabU0TnlvzHmqrjv5y2bL42YktHdqTPJCPPW+y+Q13FBPDDjDM5dHqBuS\/2RhJu3lsTsPvJ\/5y1ReuEJUqNknj6aPxVhdJnx4kPZU+9AburIs6fw\/1aNumlVE\/lyZ4KuJpNXmCqQp2JsDk+1RvP3SlLS++d1dz8cWlLBkAsUWbZyTA62xD\/2wkTnQFa9hBsUVkdLApcHTlaFT1PTK2kjmIE3mifw6HHrBI5YnbXCnOSPYE+6PFhiMRFbjvjifp2Csd\/2R\/q30GUSQ+61Fr3CFPadGaBV\/rwYGD8YMUk0nYpZElFrAq2BahYtvNXyyd1J3HjKqmmpNlJXqoIgqAgZKqyb5knsv0FqESIHA2xQ01fnV73LKs4ll4mC7hwsxob5b0JP6mEptAwhvzahSBwt7AS2p2f\/3rPCgUHb2fClGgJZrXRNxh\/A5af31hfKkhQrHXxUyW27ACzUyNF+aA==","iv":"bd85d4eda8a4651166f844bc3db55bdf","s":"72ea221bb9d1afb5"}

Luxury leaders' outlook for 2024 versus 2023. Source: Agility Research & Strategy

Luxury leaders' outlook for 2024 versus 2023. Source: Agility Research & Strategy Luxury leaders' China business strategy in 2024. Source: Agility Research & Strategy

Luxury leaders' China business strategy in 2024. Source: Agility Research & Strategy Beijing skyline at sunset

Beijing skyline at sunset Trends that the responding luxury leaders expect to take shape in 2024. Source: Agility Research & Strategy

Trends that the responding luxury leaders expect to take shape in 2024. Source: Agility Research & Strategy