The Chinese wealthy and UHNW are key to luxury's global growth. Image: Shutterstock

The Chinese wealthy and UHNW are key to luxury's global growth. Image: Shutterstock

The old truism in China was simple: the wealthier the person, the less impacted he or she would be by shocks and downturns in the economy. That, apparently, no longer holds true as evidence by the turn of events this year.

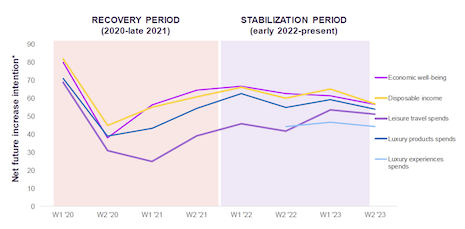

Monthly tracking data from Agility Research & Strategy’s TrendLens study has shown a dramatic decline in optimism among Chinese high-net-worth individuals' (HNWIs) across key indicators.

“After an initial rebound in the first quarter of the year, when there was hope of the return of a strong re-opening following the zero-COVID period, we have seen a steady downward trend starting from around April of 2023 and continuing for the next six months,” said Amrita Banta, managing director of Agility Research & Strategy, Singapore.

With a sample of 2,000 affluent individuals, including more than 600 HNWIs now collected continuously, the 2023-24 TrendLens program gives a granular look at Chinese luxury consumers, with visibility on changes from month to month across the year. The individuals tracked are U.S. dollar millionaires.

The study results were illuminating.

The changing face of Chinese luxury consumers and their spending patterns. Source: Agility Research & Strategy

The changing face of Chinese luxury consumers and their spending patterns. Source: Agility Research & Strategy

Poor investment performance plays role

Chinese HNWIs’ confidence in their real estate and financial investments has dropped by 27 points, from February-April to the most recent three-month period of July-September.

These HNW consumers are now less bullish about their investments than affluent consumers – the first time that Agility has registered such a situation since the market research firm began tracking data in 2016.

While the shift is being felt in the larger Tier 1 and 2 cities, by far the sharpest drop-offs have been in China’s lower-tier cities, where sentiment is significantly downwards this year.

With this sobering news, Agility notes several trends:

Chinese millionaires are still spending on experiences. Of the areas where HNWIs are most likely to increase spending on in the next six months, experience-related categories occupy four of the top seven, including entertainment, travel experiences, spas and sports.

Watches and fine jewelry also occupy high positions on their lists.

Quiet luxury is a thing for HNWIs. More than three in five HNWIs prefer buying items that are recognizable as being from a luxury brand, but in a discreet way or with no logo at all.

The trend is more stark among high-net worth women (69 percent) and those over age 40 (70 percent).

Limited editions are motivating. In our data, HNWIs name limited editions or exclusive or rare items from luxury brands as the top factor motivating luxury purchases, ahead of new products and collections, brand or product heritage or back-story.

This is especially the case among Gen Z- and millennial-aged millionaires, who are even more focused on limited editions than those in their 40s and above.

These Chinese millionaires are continuing to travel overseas and shop: Duty-free shopping is their No. 2 planned leisure activity during an overseas trip, after culinary tours.

More than half of HNWIs expect to go overseas to buy from many luxury categories – including watches, jewelry, handbags and cosmetics – at equal or greater levels than they had prior to the pandemic.

In terms of leisure destinations, France, United States and the United Kingdom are their top three choices, followed by Australia, Germany and South Korea.

As a purely shopping destination Hong Kong is the favorite, followed by European destinations including France. Sanya, Macau and Italy share fourth place in the rankings.

Among domestic destinations, Sanya remains the most popular choice, followed by Yunnan and Shanghai.

“The dynamic and constantly changing environment makes it critical to stay on top of how luxury consumers feel, think, spend and behave,” Ms. Banta said.